ccstreaminggame.ru

Community

Dynamic Asset Allocation Strategy

In this blog, we will explore the essence of dynamic asset allocation and adaptive portfolio strategies and discuss how advisors can harness these concepts to. Dynamic asset allocation, also known as DAA, refers to an active investment strategy that adjusts the allocation of assets in a portfolio in response to. DAA is used to make investment decisions across asset categories (e.g. equities versus bonds) and within asset categories (e.g. countries, sectors, styles. As risky assets (e.g., stocks) fluctuate in value, the value of a portfolio containing them may change, as may their allocation relative to the safe assets. A Dynamic Asset Allocation (DAA) structure potentially improves a plan's ability to meet all benefit obligations (short- and long-term) by matching the horizons. As risky assets (e.g., stocks) fluctuate in value, the value of a portfolio containing them may change, as may their allocation relative to the safe assets. Combining strategic and dynamic asset allocation helps ensure the risk/return balance of a portfolio remains right, while providing a smoother investment. Dynamic allocation is a modern response to seeking yield. Utilizing both traditional and alternative strategies can assist in building a portfolio that stays. What is Strategic Asset Allocation? · Strategic asset allocation (SAA) is constructed on the basis of long term asset class forecasts with targets to maintain a. In this blog, we will explore the essence of dynamic asset allocation and adaptive portfolio strategies and discuss how advisors can harness these concepts to. Dynamic asset allocation, also known as DAA, refers to an active investment strategy that adjusts the allocation of assets in a portfolio in response to. DAA is used to make investment decisions across asset categories (e.g. equities versus bonds) and within asset categories (e.g. countries, sectors, styles. As risky assets (e.g., stocks) fluctuate in value, the value of a portfolio containing them may change, as may their allocation relative to the safe assets. A Dynamic Asset Allocation (DAA) structure potentially improves a plan's ability to meet all benefit obligations (short- and long-term) by matching the horizons. As risky assets (e.g., stocks) fluctuate in value, the value of a portfolio containing them may change, as may their allocation relative to the safe assets. Combining strategic and dynamic asset allocation helps ensure the risk/return balance of a portfolio remains right, while providing a smoother investment. Dynamic allocation is a modern response to seeking yield. Utilizing both traditional and alternative strategies can assist in building a portfolio that stays. What is Strategic Asset Allocation? · Strategic asset allocation (SAA) is constructed on the basis of long term asset class forecasts with targets to maintain a.

Dynamic asset allocation funds employ a strategy wherein the allocation of assets is adjusted periodically based on market conditions and the fund manager's. Dynamic asset allocation is a strategy that involves adjusting the mix of assets in a portfolio according to the changing market conditions. Dynamic Asset Allocation (DAA) is an investment strategy that automatically adjusts a portfolio's asset mix in response to changes in market conditions. stated objective, the index uses several dynamic and tactical investment strategies. As investments and markets fluctuate over time, dynamic asset allocation. Dynamic asset allocation relies on a portfolio manager's judgment instead of a target mix of assets. This makes dynamic asset allocation the polar opposite of a. In the dynamic asset allocation strategy, there is no fixed asset mix required for the fund. Instead, fund managers actively modify the asset allocation based. In this edition of the Cordros Wealth Digest, we'll delve into the top dynamic asset allocation strategies tailored for investment growth in the Nigerian. Dynamic asset allocation is a strategy that allows an investor to adjust their portfolio allocation based on market conditions. There are no changes to the DAA lineup for May. Dynamic Asset Allocation is a defensive, low-volatility strategy that uses exchange-traded funds to rotate among. The most common dynamic asset allocation strategy used by mutual funds is counter-cyclical strategy. These funds increase their equity allocation (reduce debt. Dynamic asset allocation is a strategic investment approach that adjusts the mix of asset classes in a portfolio based on market conditions, economic indicators. There are two types of dynamic asset allocation: convergent and divergent. Nov 16, 50 Books to Read When Looking for Alternatives to 60/. An asset allocation strategy in which the asset mix is quantitatively shifted in response to changing market conditions, as in a portfolio insurance strategy. ccstreaminggame.ru: Dynamic Asset Allocation: Strategies for the Stock, Bond, and Money Markets (Wiley Finance): Hammer, David A.: Books. An asset allocation strategy diversifies investments across different asset Dynamic Asset Allocation Conservative Fund (PACYX). A globally diversified. Dynamic asset allocation is an active strategy where you constantly adjust the mix of assets in response to market fluctuations and changes in the economic. Dynamic Asset Allocation: Modern Portfolio Theory Updated for the Smart Investor [Picerno, James] on ccstreaminggame.ru *FREE* shipping on qualifying offers. Studies have found, time and time again, that a strategic allocation to global equities and global bonds gives long-term investors a good chance of success. Strategic asset allocation: Investing through the business cycle One of the key tenets of our investment process is that the past is not prologue. Therefore.

Progressive Vs Geico Motorcycle Insurance

We can help you find affordable motorcycle insurance rates and great coverage no matter what type of bike you have. This includes sport bikes, cruisers, mopeds. A company that I am considering is Progressive. For the same coverage and some additional services that GEICO doesn't provide, Progressive undercuts GEICO by at. Quote motorcycle insurance and find out why 1 in 3 insured riders choose Progressive · Progressive's discounts make motorcycle insurance affordable for all. Mike shows how the cost of motorcycle insurance may shock you! Find out the cost before committing to buying your bike. If you're not riding a motorcycle in winter, insurance isn't mandatory but it's usually best to keep your bike insured. The Better Business Bureau (BBB) offers a lot of useful information on many major companies throughout the United States, including car insurance companies. See how GEICO not only provides affordable motorcycle insurance with multiple discounts, but also provides great motorcycle insurance coverage. Get insurance from a company that's been trusted since See how much you can save with GEICO on insurance for your car, motorcycle, and more. Progressive Insurance is our top choice for best motorcycle insurance company, based on our analysis. Unlike some insurers, Progressive makes replacement cost. We can help you find affordable motorcycle insurance rates and great coverage no matter what type of bike you have. This includes sport bikes, cruisers, mopeds. A company that I am considering is Progressive. For the same coverage and some additional services that GEICO doesn't provide, Progressive undercuts GEICO by at. Quote motorcycle insurance and find out why 1 in 3 insured riders choose Progressive · Progressive's discounts make motorcycle insurance affordable for all. Mike shows how the cost of motorcycle insurance may shock you! Find out the cost before committing to buying your bike. If you're not riding a motorcycle in winter, insurance isn't mandatory but it's usually best to keep your bike insured. The Better Business Bureau (BBB) offers a lot of useful information on many major companies throughout the United States, including car insurance companies. See how GEICO not only provides affordable motorcycle insurance with multiple discounts, but also provides great motorcycle insurance coverage. Get insurance from a company that's been trusted since See how much you can save with GEICO on insurance for your car, motorcycle, and more. Progressive Insurance is our top choice for best motorcycle insurance company, based on our analysis. Unlike some insurers, Progressive makes replacement cost.

No, Progressive is not cheaper than Geico for car insurance. A minimum-coverage car insurance policy with Progressive costs $1, per year, on average, while a. GEICO and Foremost are two of the most popular insurance companies, but their discounts and policies differ. Find out which is best for you! GEICO Insurance Reviews. GEICO is known for its competitive premium rates and a wide variety of discounts. It offers products like home insurance, motorcycle. I don't think auto insurance companies. know how far I would go to save money. That every auto renewal, they always increase my rates. Best for various types of motorcycles: State Farm · Best for availability: Progressive · Best for bundling: Geico · Best for discounts: Harley-Davidson Insurance. Esurance, while offering fewer states coverage, provides unique discounts such as the Fast 5 and Pac discounts. Both companies have strong. Ride with affordable and personalized motorcycle insurance from the #1 motorcycle insurer. Find out about Progressive's motorcycle coverages and discounts. GEICO's Motorcycle Insurance Offers You: · Save Money on Outstanding Motorcycle Coverage · Review These Motorcycle Insurance Discounts · Great Service at an. Comparing Progressive's Rates with Other Providers · Geico: Known for competitive rates, Geico often offers the cheapest minimum-coverage insurance, averaging. Both Geico and Progressive offer competitive average premiums for drivers, but if cost is your primary consideration, Geico has the edge. Its average rates tend. No, Progressive is not cheaper than Geico for car insurance. A minimum-coverage car insurance policy with Progressive costs $1, per year, on average, while a. So you must choose a provider wisely. Only the insurance company you select—whether Allstate, Progressive, USAA, Farmer's, GEICO, or. Motorcycle Insurance Discounts Available · Up to 10% discount when you transfer your motorcycle insurance to GEICO® Motorcycle. · Up to 10% discount if you insure. You can also get multi-policy discounts for RV, boat, motorcycle, and more. Save by bundling insurance›. Compare car insurance rates. Get a free car insurance. Geico is cheaper for high coverage. Geico is notably cheaper than Progressive in this category as well. Its sample rate is 16% less than the U.S. average. Protect your golf cart with golf cart insurance. Learn when you need it, your coverage options, and how Progressive can help you save. Who are you guys finding for insurance? Both progressive and geico don't list swm so they won't cover it. Get an insurance quote in minutes from a top-rated company. Find 24/7 support and insurance for you, your family, and your belongings. Progressive Motorcycle Insurance has a higher overall rating than Allstate Motorcycle Insurance. Progressive scores better than Allstate across: Coverage and.

Coinbase Pro Earn Interest

Yes, you can make money just by keeping cryptocurrencies on Coinbase Pro and engaging in a procedure known as "staking." Staking is a method of. In your Coinbase app, navigate to the ETH asset page. You'll see a prompt to stake your ETH. At the time of publishing, the rewards rate is up to % APY. The. As of June , you can earn % APY rewards by simply holding Dai in your Coinbase account. You can also earn % APY for holding USD Coin — and can earn. Coinbase distributes rewards, earned for the days in which you have a balance of at least $1 of USDC on Coinbase, every month. Cryptocurrency earning opportunities: Earn interest on qualified holdings, or use Coinbase Earn to receive a tiny amount of a new currency. Coinbase Pro. Earn. Earn interest on your crypto ·. Learning rewards. Learn and earn crypto Pro. Professional grade tools ·. Derivatives. Trade an accessible futures. Coinbase distributes rewards, earned for the days in which you have a balance of at least $1 of USDC on Coinbase, every month. Offers passive earning opportunities on over assets: Earn an annual interest It's a huge leap from Coinbase Pro, Coinbase's former advanced. If you get into ALGO I would move your coins to the dedicated ALGO wallet. When you use coinbase, they take ~1% of the APY so you only earn 6%. Yes, you can make money just by keeping cryptocurrencies on Coinbase Pro and engaging in a procedure known as "staking." Staking is a method of. In your Coinbase app, navigate to the ETH asset page. You'll see a prompt to stake your ETH. At the time of publishing, the rewards rate is up to % APY. The. As of June , you can earn % APY rewards by simply holding Dai in your Coinbase account. You can also earn % APY for holding USD Coin — and can earn. Coinbase distributes rewards, earned for the days in which you have a balance of at least $1 of USDC on Coinbase, every month. Cryptocurrency earning opportunities: Earn interest on qualified holdings, or use Coinbase Earn to receive a tiny amount of a new currency. Coinbase Pro. Earn. Earn interest on your crypto ·. Learning rewards. Learn and earn crypto Pro. Professional grade tools ·. Derivatives. Trade an accessible futures. Coinbase distributes rewards, earned for the days in which you have a balance of at least $1 of USDC on Coinbase, every month. Offers passive earning opportunities on over assets: Earn an annual interest It's a huge leap from Coinbase Pro, Coinbase's former advanced. If you get into ALGO I would move your coins to the dedicated ALGO wallet. When you use coinbase, they take ~1% of the APY so you only earn 6%.

Earn up to % APY *Ability to stake subject to location and rate subject to change. Staking Ethereum. Any APR shown is a rough estimate of how much cryptocurrency you will earn in rewards over the time period you choose. It does not display the actual or. Income tax: If you earn cryptocurrency as a form of income, this is considered ordinary income and will be taxed accordingly. Earning cryptocurrency interest. Coinbase Pro, a professional asset trading platform for trading digital assets Coinbase Earn, a cryptocurrency learning platform that rewards users. Stake your crypto and earn up to 10% APY. Put your crypto to work and earn staking rewards with Ethereum (ETH), Polkadot (DOT), Solana (SOL), Cosmos (ATOM). Coinbase Wallet is the easiest and safest way to view and collect NFTs, earn • Hold: Lend crypto with decentralized finance (DeFi) and earn interest*. Pros. Non-custodial, DeFi Wallet available. Added benefits for locking CRO. Multiple ways to earn crypto or interest. Cons. Customer service isn't responsive. Interest paid in crytpo will fluctuate according to its market price. Pro you can earn USD value of a crypto and that crypto goes up 10x. At the time of writing, Coinbase offers % interest rewards on USDC — making it a great way to earn a passive income. The average interest rate for holding. But wait, there's more Your Coinbase account lets you trade, earn, spend, send, and borrow. When you aren't trading, earn 5%* rewards automatically just by. After each tutorial you'll receive a simple quiz testing what you've learned. Earn. You'll receive crypto in Coinbase for every quiz you complete. Start today. Earn % APY on USDC. Join Coinbase One today and get % APY on your first $30, USDC, zero trading fees, priority support, and more. Boosted staking rewards: The APY you receive depends on the rewards received from the network, which can change over time. Coinbase takes a commission on all. Coinbase only has a limited number of crypto that will allow you to earn interest through staking. You can get the yield by storing your assets. Yes, multiple other platforms and programs like Atomic Wallet Staking let you hold cryptocurrencies and earn interest generated on coins like Algorand, Tezos. Coinbase charges a fee of $ to $ per trade depending on the size, plus a spread of about % between buying and selling prices. On Coinbase Pro, you. Coinbase Earn is Coinbase's interest-bearing product. They offer staking-as-a-service on supported assets and, more specifically, interest on USDC (Circle). When utilizing Coinbase Pro, trading fees can be anywhere from 0% to % per trade. Users can expect to pay a taker fee between % to % and a maker fee. Staking rewards on Coinbase Prime ; Kusama (KSM). %. Every six hours ; Near protocol (NEAR). %. hours (1 epoch) ; Polkadot (DOT). %. Era | Staking is a way to earn rewards (cryptocurrency) while helping strengthen the security of the blockchain network. You can unstake your crypto at any time, and.

Historical Return Of The S&P 500

The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. The nominal return on investment of $ is $33,, or 33,%. This means by you would have $33, in your pocket. However, it's important to. Backtest by Curvo is the best backtesting simulator for European index investors. Discover the historical performance of your portfolio and compare it to others. Annual S&P ® Index Price Returns for – The S&P ® Index is comprised of the stocks of large companies that are publicly traded on major US. The index has returned a historic annualized average return of around % since its inception through the end of While that average number may. S&P Index | historical charts for SPX to see performance over time with comparisons to other stock exchanges. Discover historical prices for ^GSPC stock on Yahoo Finance. View daily, weekly or monthly format back to when S&P stock was issued. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. View data of the S&P , an index of the stocks of leading companies in the US economy, which provides a gauge of the U.S. equity market. The S&P ® is widely regarded as the best single gauge of large-cap U.S. equities. The index includes leading companies and covers approximately 80%. The nominal return on investment of $ is $33,, or 33,%. This means by you would have $33, in your pocket. However, it's important to. Backtest by Curvo is the best backtesting simulator for European index investors. Discover the historical performance of your portfolio and compare it to others. Annual S&P ® Index Price Returns for – The S&P ® Index is comprised of the stocks of large companies that are publicly traded on major US. The index has returned a historic annualized average return of around % since its inception through the end of While that average number may. S&P Index | historical charts for SPX to see performance over time with comparisons to other stock exchanges. Discover historical prices for ^GSPC stock on Yahoo Finance. View daily, weekly or monthly format back to when S&P stock was issued. The Standard and Poor's , or simply the S&P , is a stock market index tracking the stock performance of of the largest companies listed on stock. View data of the S&P , an index of the stocks of leading companies in the US economy, which provides a gauge of the U.S. equity market.

1 S&P ® Index inception date is Performance displayed represents past performance, which is no guarantee of future results. For more information. Discover real-time S&P (SPX) share prices, quotes, historical data, news, and Insights for informed trading and investment decisions. The compound return across is %, in simplest terms meaning that a $ investment in shares of S&P firms in that year would have grown to. 4, - 5, Performance. 5 Day. %. 1 Month. %. 3 Month. Historical and current end-of-day data provided by FACTSET. All quotes are. Historical Returns on Stocks, Bonds and Bills: Data Used: Multiple S&P (includes dividends), 3-month ccstreaminggame.ru, US T. Bond (year), Baa. In the last 32 years, the S&P index (in EUR) had a compound annual growth rate of %, a standard deviation of %, and a Sharpe ratio of Analysis of S&P (IE00B5BMR) based on historical data between February and July It includes the growth rate, Sharpe ratio, drawdown chart. S&P Monthly Return is at %, compared to % last month and % last year. This is higher than the long term average of %. return produced by the S&P starting in all the way through There are two major takeaways from the chart below: 1. Historically, once the long. SPDR S&P ETF Trust (SPY) ; Annual Total Return (%) History. Year. SPY. Category. %: %. %: %. %: %. S&P Total Returns by Year ; , ; , ; , ; , Stock market returns since If you invested $ in the S&P at the beginning of , you would have about $1,, at the end of , assuming. The S&P S&P Global uses cookies to improve user experience and site performance, offer advertising tailored to your interests and enable social media. Calculations are from the first trading day of each year. current-year value previous-year value. Past performance is not an indicator nor a guarantee of future. S&P Historical Data ; Highest: 5, ; Change %. ; Average: 5, ; Difference: ; Lowest: 5, Over the very long run, the stock market has had an inflation-adjusted annualized return rate of between six and seven percent. Another pattern: while stocks. Real returns. While inflation affects individual companies and industries differently, the S&P over the long term has historically provided positive real. I commonly hear that the S&P , and thus VOO/ SPY/ etc, has averaged % per year since it's inception. Therefore, there is nothing. S&P Annual Total Return is at %, compared to % last year. This is higher than the long term average of %. The S&P Annual Total Return. Past performance does not guarantee future returns. The historical performance is meant to show changes in market trends across the different S&P sectors.

Cost To Install Complete Hvac System With Ductwork

HVAC systems with ductwork can range in price from $1, to $6,, with the average homeowner spending around $3, on HVAC installation. You. install ductwork, along with per unit costs and material requirements. See professionally prepared estimates for hvac ductwork installation work. The Homewyse. If only a small section of your home's ductwork needs replacing, you could pay just $10 to $20 per linear foot (plus labor costs). General HVAC Repairs. You can. This cost estimate for installing ductwork is based on several key assumptions and average market prices. The cost calculation is based on covering an average. Change-out HVAC costs are between $5, and $9, The cost of installing a new system with ductwork is between $8, and $14, Installing a system with. Average cost to install ductwork is about $ Find here detailed information about ductwork installation costs. You may also need to replace ductwork when installing a new central air conditioning (AC) unit or furnace. This costs around $2, for an average-sized. Air conditional Central air conditioners work to keep your entire home cool by circulating air through the cooling coils. Larger homes may need separate systems. HVAC ductwork installation averages $1, to $2, for a 1,square-foot system—so without the removal fees, you'll pay between $8, and $19, for a new. HVAC systems with ductwork can range in price from $1, to $6,, with the average homeowner spending around $3, on HVAC installation. You. install ductwork, along with per unit costs and material requirements. See professionally prepared estimates for hvac ductwork installation work. The Homewyse. If only a small section of your home's ductwork needs replacing, you could pay just $10 to $20 per linear foot (plus labor costs). General HVAC Repairs. You can. This cost estimate for installing ductwork is based on several key assumptions and average market prices. The cost calculation is based on covering an average. Change-out HVAC costs are between $5, and $9, The cost of installing a new system with ductwork is between $8, and $14, Installing a system with. Average cost to install ductwork is about $ Find here detailed information about ductwork installation costs. You may also need to replace ductwork when installing a new central air conditioning (AC) unit or furnace. This costs around $2, for an average-sized. Air conditional Central air conditioners work to keep your entire home cool by circulating air through the cooling coils. Larger homes may need separate systems. HVAC ductwork installation averages $1, to $2, for a 1,square-foot system—so without the removal fees, you'll pay between $8, and $19, for a new.

Prices vary based on many factors, including the system type, SEER rating, and ductwork. The national average cost range for installing central AC is $5, to. The basic cost to Install Air Conditioning is $ - $ per unit in August , but can vary significantly with site conditions and options. How Long Does Installation Take? Depending on the type of system, most typical central air conditioner installations can be completed by an experienced. Average cost to install ductwork is about $ Find here detailed information about ductwork installation costs. $16, INCLUDING running all necessary ductwork for both floors, and equipment, copper, low voltage, and line set cover would be a good price. Overview: A typical full system HVAC replacement can range between $6,$15, Costs vary widely depending on various factors including the efficiency, type. Ductwork: The expense for ductwork is calculated based on its quantity, with the average cost being about $15 to $20 for every linear foot. Installation. Installing an HVAC system with ductwork typically costs between $39, and $,, averaging $8 to $15 per square foot. This estimate includes the HVAC. This price covers everything from removing existing materials to installing new air ducts. Ductwork materials cost about $12 to $25 per linear foot. If you need. Depending on the size of the house and the duct placement and material, adding new HVAC ductwork typically costs between $1, to $16, These figures are. ACs use ducts to keep your home cool. If ducts already exist in your home or you plan to install them, you can also get a central air conditioning unit. It. Central air conditioning systems are among the most popular choices for cooling entire homes. They consist of an indoor air handler and an outdoor condenser. Change-out HVAC costs are between $5, and $9, The cost of installing a new system with ductwork is between $8, and $14, Installing a system with. Installing an HVAC system with ductwork typically costs between $39, and $,, averaging $8 to $15 per square foot. This estimate includes the HVAC. That would depend on what “type" of system and who is installing ccstreaminggame.ru little as 2, for a split to 10–11 grand for ducted a.c.. The. For example, if you were having a new 3-ton central air system installed that comes with a SEER of 16, and if your 2, square foot home needed ductwork, you. The installed cost of an air course, split system heat pump system ranges from $4, to $8, for average-sized homes. Large, high-performance heat pumps can. If your current air conditioner (AC) isn't maintaining your desired home temperature, you may need a new central air conditioning unit. Installing central. Installing a new HVAC system and ductwork is no easy task. Labor can cost anywhere from $ to $2, depending on the current state of your system. If you're.

3 Ways To Invest In Real Estate

What are my investment options? · Rental properties. · REITs. · Real estate investment groups. · Flipping houses. · Real estate limited partnerships. · Real estate. 1. Commercial property real estate ETFs · 2. Commercial property real estate mutual funds · 3. Commercial property REITs · 4. Commercial property real estate. You have lots of options for investing in real estate, from buying an actual piece of property and renting it out to purchasing small shares of real estate. It consists of four steps a young person should follow to set themselves up to buy their first real estate investment property before they can legally purchase. 1. Rental Properties · 2. Real Estate Investment Groups (REIGs) · 3. House Flipping · 4. Real Estate Investment Trusts (REITs) · 5. Online Real Estate Platforms. 7 Ways to Start Investing in Real Estate · 1. Land speculation · 2. Property flipping · 3. Short-term rentals · 4. Small-scale residential rental properties · 5. Buy a property by yourself via seller financing with 4 months worth of prepayments and 2 months of reserves in the bank at minimum. Make sure. How to Invest in Real Estate: 9 Ways to Get Started · 1. Buy a Home · 2. Become a Landlord · 3. Flipping Houses · 4. House Hacking · 5. Buy a Vacation Property · 6. Invest in a REIT (real estate investment trust) · Invest in real estate mutual funds · Invest in properties via real estate crowdfunding · Purchase pre-vetted. What are my investment options? · Rental properties. · REITs. · Real estate investment groups. · Flipping houses. · Real estate limited partnerships. · Real estate. 1. Commercial property real estate ETFs · 2. Commercial property real estate mutual funds · 3. Commercial property REITs · 4. Commercial property real estate. You have lots of options for investing in real estate, from buying an actual piece of property and renting it out to purchasing small shares of real estate. It consists of four steps a young person should follow to set themselves up to buy their first real estate investment property before they can legally purchase. 1. Rental Properties · 2. Real Estate Investment Groups (REIGs) · 3. House Flipping · 4. Real Estate Investment Trusts (REITs) · 5. Online Real Estate Platforms. 7 Ways to Start Investing in Real Estate · 1. Land speculation · 2. Property flipping · 3. Short-term rentals · 4. Small-scale residential rental properties · 5. Buy a property by yourself via seller financing with 4 months worth of prepayments and 2 months of reserves in the bank at minimum. Make sure. How to Invest in Real Estate: 9 Ways to Get Started · 1. Buy a Home · 2. Become a Landlord · 3. Flipping Houses · 4. House Hacking · 5. Buy a Vacation Property · 6. Invest in a REIT (real estate investment trust) · Invest in real estate mutual funds · Invest in properties via real estate crowdfunding · Purchase pre-vetted.

Real estate investment trust (REITs) and real-estate focused ETFs can be an easy, and low cost way to get started in real estate investing. Another option might. 1. Rent Out a Room or a Part of Your House · 2. REITs or Real Estate Investment Trusts · 3. Investing in a Rental Property · 4. House Flipping · 5. Real Estate. STEP 1. Open a Self-Directed IRA ; STEP 2. Fund your account ; STEP 3. Find your investment property ; STEP 4. Make an Earnest Money Deposit (EMD) ; STEP 5. Prepare. Real Estate Investment Trusts (REITs): In a real estate investment trust, the owner of multiple commercial properties sells shares to investors. If you buy. The idea behind REIT investing is to participate in the often higher returns of real estate assets without owning or managing any real property. 6. Borrow your. Buy a property by yourself via seller financing with 4 months worth of prepayments and 2 months of reserves in the bank at minimum. Make sure. Invest in Real Estate Investment Trusts (REITs) – A Real Estate Investment Trust (REIT) is a company that owns and manages property investments. REITs typically. The idea behind REIT investing is to participate in the often higher returns of real estate assets without owning or managing any real property. 6. Borrow your. What is SFR in real estate investing? As SFR returns are typically not correlated to the stock market, they can be attractive to a wide range of investors. Just like Stock Market Mutual Funds, Real Estate mutual funds are profitable and provide you an opportunity to invest in various types of properties without. Just about anyone can start investing in real estate, even with as little as $10, thanks to technology and loosened crowdfunding regulations. Instead, you can buy fractional ownership in properties through some real estate crowdfunding platforms. You buy an ownership share in a rental property for $ 3. Crowdfunded real estate properties: Real estate crowdfunding is a way to purchase shares or debt issued by a company that owns or is looking to buy real. How to Invest in Real Estate is the ultimate strategy guide to help you achieve personal and financial success through real estate investing. Josh Dorkin and. Some common methods include purchasing rental properties, investing in real estate investment trusts (REITs), participating in crowdfunding. 1. Rental Properties · 2. REITs · 3. Real Estate Investment Groups (REIGs) · 4. Real Estate Limited Partnership (RELP) · 5. Real Estate Mutual Funds. Real estate investment trust (REITs) and real-estate focused ETFs can be an easy, and low cost way to get started in real estate investing. Another option might. 1. Rentals · 2. Buy and Hold Property · 3. Buy and Flip Homes · 4. Real Estate Crowdfunding · 5. Real Estate Investment Trust (REIT). These websites' investing models differ. Some buy properties directly and allow investors to invest money in pooled funds similar to publicly traded REITs. It consists of four steps a young person should follow to set themselves up to buy their first real estate investment property before they can legally purchase.

Stablecoin Apy

Leaderboard of the highest stablecoin interest rates to earn yield in CeFi. Top APR / APY rates of August , from the best stablecoin interest accounts. Trading cryptocurrency such as Bitcoin or Ethereum for stablecoin Many popular crypto applications like BlockFi allow users to earn interest in stablecoin. Latest stablecoin lending rates ; First Digital USD (FDUSD) · Aave, Up to % APY ; PayPal USD (PYUSD) · Aave, Up to % APY ; USDD (USDD). ccstreaminggame.rue finds the best, risk-adjusted yield for traders by fully automating crypto yield Step one. All stablecoin deposits are pooled. Pooled. Latest stablecoin lending rates ; Tether (USDT) · Nexo, Up to 16% APY ; USDC (USDC) · Nexo, Up to 14% APY ; Dai (DAI) · Nexo, Up to 14% APY. Best Places to earn Stablecoin Yields >20% APR/APY — $LUSD Edition · $ERN-$LUSD Vault on ccstreaminggame.ru: % APY · $USDT-$LUSD Vault on Velodrome. Stablecoin Rates on Yield App · 6% = stake between 1,, YLD -> stake stablecoins with Earn+ for 7% APY · 7% = stake between 10,, YLD -> stake. Here's everything you need to know about lending stablecoins for interest like USDC, USDT, and DAI. Plus, how and where to lend stablecoins. Stablecoins are a type of cryptocurrency designed to have a steady value over time relative to a reference asset, for example, the U.S. dollar. They can provide. Leaderboard of the highest stablecoin interest rates to earn yield in CeFi. Top APR / APY rates of August , from the best stablecoin interest accounts. Trading cryptocurrency such as Bitcoin or Ethereum for stablecoin Many popular crypto applications like BlockFi allow users to earn interest in stablecoin. Latest stablecoin lending rates ; First Digital USD (FDUSD) · Aave, Up to % APY ; PayPal USD (PYUSD) · Aave, Up to % APY ; USDD (USDD). ccstreaminggame.rue finds the best, risk-adjusted yield for traders by fully automating crypto yield Step one. All stablecoin deposits are pooled. Pooled. Latest stablecoin lending rates ; Tether (USDT) · Nexo, Up to 16% APY ; USDC (USDC) · Nexo, Up to 14% APY ; Dai (DAI) · Nexo, Up to 14% APY. Best Places to earn Stablecoin Yields >20% APR/APY — $LUSD Edition · $ERN-$LUSD Vault on ccstreaminggame.ru: % APY · $USDT-$LUSD Vault on Velodrome. Stablecoin Rates on Yield App · 6% = stake between 1,, YLD -> stake stablecoins with Earn+ for 7% APY · 7% = stake between 10,, YLD -> stake. Here's everything you need to know about lending stablecoins for interest like USDC, USDT, and DAI. Plus, how and where to lend stablecoins. Stablecoins are a type of cryptocurrency designed to have a steady value over time relative to a reference asset, for example, the U.S. dollar. They can provide.

CoinRabbit offers opportunities for users to earn interest on stablecoins; this way, stablecoin owners can earn interest by depositing their coins at CoinRabbit. Stablecoins are a type of cryptocurrency designed to have a steady value over time relative to a reference asset, for example, the U.S. dollar. They can provide. What is Stablegains and how does it work? Stablegains is a crypto startup that, in its current iteration, offers a crypto savings account. They're able to offer. Summary. Using the protocol ccstreaminggame.ru, users can collateralize crypto assets — including interest bearing tokens (ibTKNs) — to mint magic internet. Earn % rewards by simply holding USDC on Coinbase. USDC is a trusted stablecoin that is designed to be pegged and redeemable for US dollars. Explore the best stablecoin yields across 30+ different networks. ✓ ccstreaminggame.ru lets you quickly find the best DeFi farming opportunities for your portfolio. Note: The blue dots show the borrow rates on the three stablecoins DAI, USDC and USDT, issued respectively by. Maker DAO, Circle and Tether. At the start of. Earn an APR of up to 13% on stablecoins! Find the best stablecoin returns offered by trusted cryptocurrency platforms. Compare best stablecoin staking rates. Get highest APY from different platforms. YouHodler Crypto Yield account - generate reward in their crypto with the highest percentage rates, full transparency, and total control over their. At the start of January , the average intraday rate charged to borrow a stablecoin on the platforms Aave v1, v2 and v3, and Compound v2 and v3 was close to. Compare Top Stablecoin Interest Rates ; EarnPark · 15% · 20% ; Maple Finance · 7% · 6% ; Wirex · % – % · 4% – % ; M2 · % – % · 3% – %. Earn up to 12% APY on your crypto. · Check out all the ways to earn · Get paid to stake · More about how staking works · Earn staking rewards across Coinbase. Circle is building the largest, most widely used stablecoin network so billions around the world can access digital dollars for payments and liquidity. Staking. Another way to earn interest on stablecoins is to stake them in a protocol to ensure the smooth running of the network. This process is common in. Invest in stablecoins with AQRU and enjoy up to 10% APY returns! AQRU is an innovative investment platform that allows you to earn interest on your stablecoins. Liquity's efficient liquidation mechanism allows users to get the most liquidity for their ETH. *Under normal operation. Unstoppable Stablecoin. LUSD is an. stablecoin of equal or less representative value. Coin Name. In-CEL Reward Rate (APY). Accredited investor at Platinum level*. In-Kind Reward Rate (APY). MCDAI. In traditional finance, APY is used for things like savings accounts and certificates of deposit. In crypto, there are many ways to earn interest on your. Our user-friendly USDC APY Calculator demystifies investment return calculations for USD Coin. Input the amount you intend to invest in USDC, and the calculator.

What Is Environmental Social Governance

Environmental Social Governance(ESG) is a balanced scorecard for non-financial impacts, risks, and opportunities. ESG stands for “Environmental, Social and Governance” and refers to criteria used by companies and stakeholders to assess the sustainability and responsibility. ESG is a framework that helps stakeholders understand how an organization manages risks and opportunities around sustainability issues. ESG has evolved from. Environmental social governance, or ESG, is a set of standards for measuring the sustainability and ethical impact of businesses and organisations. ESG stands for environmental, social, and governance. ESG is used by investors and companies to understand and communicate business performance, practices. ESG is a tool to evaluate a company's environmental and social impact and the transparency and accountability of its governance. Investors use ESG to screen. ESG refers to the environmental, social, and governance factors that investors measure when analyzing a company's sustainability efforts from a holistic view. Our human-led, tech powered ESG consulting services will help you bolster and prepare for the ESG revolution. ESG is an acronym that stands for Environmental, Social, and Governance. It is a framework used to measure a business's non-financial performance. Environmental Social Governance(ESG) is a balanced scorecard for non-financial impacts, risks, and opportunities. ESG stands for “Environmental, Social and Governance” and refers to criteria used by companies and stakeholders to assess the sustainability and responsibility. ESG is a framework that helps stakeholders understand how an organization manages risks and opportunities around sustainability issues. ESG has evolved from. Environmental social governance, or ESG, is a set of standards for measuring the sustainability and ethical impact of businesses and organisations. ESG stands for environmental, social, and governance. ESG is used by investors and companies to understand and communicate business performance, practices. ESG is a tool to evaluate a company's environmental and social impact and the transparency and accountability of its governance. Investors use ESG to screen. ESG refers to the environmental, social, and governance factors that investors measure when analyzing a company's sustainability efforts from a holistic view. Our human-led, tech powered ESG consulting services will help you bolster and prepare for the ESG revolution. ESG is an acronym that stands for Environmental, Social, and Governance. It is a framework used to measure a business's non-financial performance.

ESG stands for Environmental, Social, and Governance. The E in ESG refers to a company's environmental impact and practices. ESG stands for “environmental, social, and governance,” and is a framework that considers non-financial factors impacting a company's long-term success. ESG investing plays a pivotal role in fostering innovation. By integrating environmental, social and governance factors into investment decisions, ESG investing. Environmental, social and governance (ESG) considerations are integrated into the policies and principles that govern our business and reflect our. Environmental, social and governance (ESG) is a set of standards for how a company operates in regard to the planet and its people. ESG is important because. ESG is an investment philosophy that says that investors should consider how a company aligns with a set of views on climate change, social justice, and. McKinsey brings a unique approach to ESG focused on value creation that involves benchmarking, strategy development, initiative design, program execution. ESG (Environmental, Social, and Governance) is a framework that measures the sustainable and ethical behaviour of a business. Learn more! Environmental, social, and governance (ESG) is a framework used to assess an organization's business practices and performance related to sustainability and. ESG is a tool to evaluate a company's environmental and social impact and the transparency and accountability of its governance. Investors use ESG to screen. ESG stands for environmental, social, and (corporate) governance. It is a set of practices and metrics used to evaluate a company beyond its financial. Environmental, social and governance (ESG) refers to a collection of corporate performance evaluation criteria that assess the robustness of a company's. The PRI works with its signatories to identify key environmental, social and governance (ESG) issues in the market. It produces guidance materials. ESG stands for Environmental, Social, and Governance. It is a framework used to evaluate a company's sustainability and ethical impact. McKinsey brings a unique approach to ESG focused on value creation that involves benchmarking, strategy development, initiative design, program execution. Environmental, social, and governance (ESG) is shorthand for an investing principle that prioritizes environmental issues, social issues, and corporate. The ESG is an investment philosophy that considers not only the return on investment but also whether the company meets social responsibility standards. ESG ratings are used to evaluate a company based on its environmental, social, and governance practices, to provide transparency for investors, customers, and. Environmental, Social, Governance (ESG) is about driving business growth while building a more sustainable, equitable, and ethical future for the world. ESG” stands for environmental, social, and governance. ESG investing is a way of investing in companies based on their commitment to one or more ESG factors.

Atm Cards For Teens

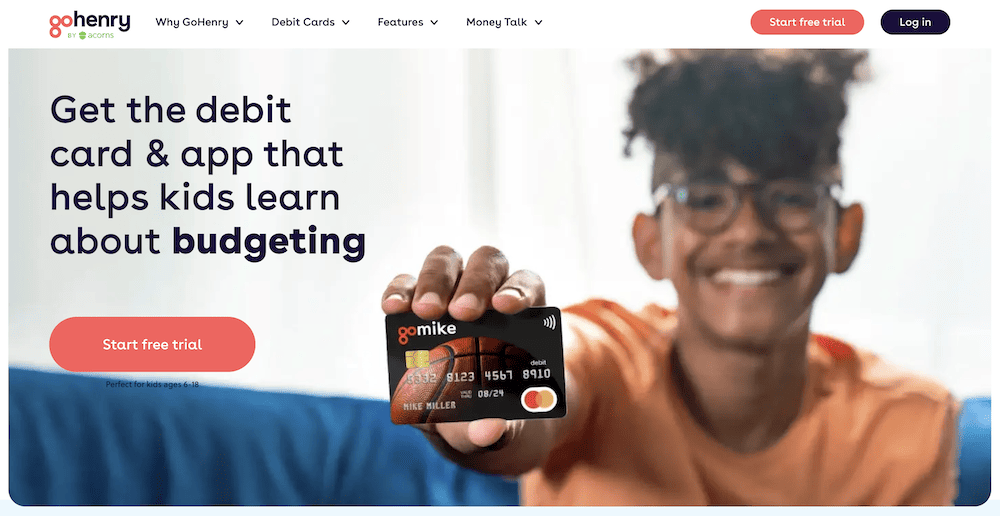

First National Bank offers several choices of checking accounts. Simple Cash Back is the most popular with teens and their parents/guardians. It's preferred. The Current Visa® Debit Card issued by Choice Financial Group, and the Current Visa® secured charge card issued by Cross River Bank, are both pursuant to. For teens age 13 - 16, look no further than the Clear Access Banking account. Great for middle and high school students and parents who want a joint account. OneAZ's debit card for teens allows your child to learn the basics of smart spending, saving, budgeting and more. Apply for a teen debit card today. The Venmo Teen Debit Card is available for eligible users years old with parent or legal guardian sign up. Terms apply. 1ATMs must display the Mastercard®. Children's bank accounts are fee-free so they won't cost you anything, unlike most prepaid cards. Your child can't go overdrawn. However, like with prepaid. The Greenlight Kids' Debit Card is our top overall pick for kids and teens, offering chore management, instant transfers, real-time notifications. Help your kids feel financially independent with a GoHenry kids' debit card. It's just like a regular kids' bank account—but way better! Who can get one? Teens ages are eligible for a Teen Debit Card and the Venmo app with sign-up from a parent or legal guardian. First National Bank offers several choices of checking accounts. Simple Cash Back is the most popular with teens and their parents/guardians. It's preferred. The Current Visa® Debit Card issued by Choice Financial Group, and the Current Visa® secured charge card issued by Cross River Bank, are both pursuant to. For teens age 13 - 16, look no further than the Clear Access Banking account. Great for middle and high school students and parents who want a joint account. OneAZ's debit card for teens allows your child to learn the basics of smart spending, saving, budgeting and more. Apply for a teen debit card today. The Venmo Teen Debit Card is available for eligible users years old with parent or legal guardian sign up. Terms apply. 1ATMs must display the Mastercard®. Children's bank accounts are fee-free so they won't cost you anything, unlike most prepaid cards. Your child can't go overdrawn. However, like with prepaid. The Greenlight Kids' Debit Card is our top overall pick for kids and teens, offering chore management, instant transfers, real-time notifications. Help your kids feel financially independent with a GoHenry kids' debit card. It's just like a regular kids' bank account—but way better! Who can get one? Teens ages are eligible for a Teen Debit Card and the Venmo app with sign-up from a parent or legal guardian.

A debit card can provide the tool needed to build on lessons about managing an allowance, setting savings goals, evaluating needs vs. wants, and identifying. The GoHenry debit card for teens gives you the independence you need. Pay, get paid, save, budget, shop, and learn the skills that will help you now—and in the. We've evaluated more than a dozen providers to come up with this list of the best prepaid debit cards for kids. Each one excels in at least one area and offers. Teens learn to manage their money — you keep an eye on their spending. Make purchases online and in-store anywhere Mastercard is accepted. Fee-free debit card Kids can use their card to access their money at 70,+ fee-free ATMs nationwide. Use your ServU Visa Debit Card to initiate both Visa debit transactions and Non-Visa debit transactions without using a personal identification number (PIN). TD Go is a reloadable prepaid card that gives your teen the freedom to purchase items online, in person, over the phone, or through their smartphone. Why Consider a debit card for your teen? · A debit card is safer to carry than cash. If your teen loses their wallet with cash in it, they're out of luck. · A. Many banks and companies offer debit cards for kids with extra features that allow parents to monitor and, in some cases, control what their child spends. I'm looking for an alternative option to my current set up with Chase. I have a Chase Premiere Checking account, and two kids checking accounts for my teens. Compare the best debit cards for kids. We reviewed cards based on fees, availability, rewards, ATM access, and more. Our expert picks include Greenlight. Teen accounts receive a simplified Venmo experience that allows teens to securely send money to friends on Venmo and get paid back. See they're running low on. Debit cards are available to First Checking account holders ages 13 and up. Your teen will need a photo ID which can be a student ID, passport, driver's license. The Mydoh Smart Cash Card is a reloadable, prepaid Visa card that gives parents a front row seat to the greatest show on earth: watching your kids gain. Teen accounts receive a simplified Venmo experience that allows teens to securely send money to friends on Venmo and get paid back. See they're running low on. Get the Greenlight app and reloadable debit card for kids and teens at no cost when you sign up for a U.S. Bank Smartly® checking account. One affordable app that teaches your kids the value of money, how to handle it, spend it wisely, donate it, and even learn how to invest it. We've evaluated more than a dozen providers to come up with this list of the best prepaid debit cards for kids. Each one excels in at least one area and offers. A debit card would be better, and better at teaching him to manage money, but should a debit card number get compromised, money in the account is GONE. Till is a fee-free debit card and mobile app for kids and teens designed to teach financial literacy through real-world practice, so they learn to earn, save.

Housing Market Collapse

While a housing market crash isn't expected in , it's still a good idea to plan for every eventuality. House prices rose in January for the fourth successive month, dampening fears of an impending property market crash. The average price of a property in the. The collapse of the United States housing bubble and high interest rates led to unprecedented numbers of borrowers missing mortgage repayments and becoming. For those thinking there will be a housing market crash any time soon, you will likely be disappointed. We're past the bottom of the real estate cycle with. Graph and download economic data for Median Sales Price of Houses Sold for the United States (MSPUS) from Q1 to Q2 about sales, median, housing. The short answer is that home prices in some areas of Florida have started coming down from their peaks in I wouldn't call it a crash but we are without. This period, during the run-up to the crash, is also known as froth. The questions of whether real estate bubbles can be identified and prevented, and whether. The housing sector led not only the financial crisis, but also the downturn in broader economic activity. Residential investment peaked in , as did. Feel free to join us and share in the information/discussions and daily market updates since 11/11/ ccstreaminggame.ru While a housing market crash isn't expected in , it's still a good idea to plan for every eventuality. House prices rose in January for the fourth successive month, dampening fears of an impending property market crash. The average price of a property in the. The collapse of the United States housing bubble and high interest rates led to unprecedented numbers of borrowers missing mortgage repayments and becoming. For those thinking there will be a housing market crash any time soon, you will likely be disappointed. We're past the bottom of the real estate cycle with. Graph and download economic data for Median Sales Price of Houses Sold for the United States (MSPUS) from Q1 to Q2 about sales, median, housing. The short answer is that home prices in some areas of Florida have started coming down from their peaks in I wouldn't call it a crash but we are without. This period, during the run-up to the crash, is also known as froth. The questions of whether real estate bubbles can be identified and prevented, and whether. The housing sector led not only the financial crisis, but also the downturn in broader economic activity. Residential investment peaked in , as did. Feel free to join us and share in the information/discussions and daily market updates since 11/11/ ccstreaminggame.ru

The market crashed in because too many people had taken on loans they couldn't afford. Easy credit and rising home prices resulted in a speculative real. House prices generally go up over the long term, but real estate – a cyclical market that responds to the ebbs and flows of the wider economy – is likely to see. This massive influx of listings, coupled with stagnating demand, causes prices to plummet and results in a “housing market crash.” A housing market crash is. The housing market heading down for a crash? Should I hold on buying a home right now, or should I wait to see if a crash happens and tisk paying more later? The Ontario housing market is forecast to see a per cent increase in sales activity and a per cent boost in home prices. Buyers' Strike Deepened in August Despite Lower Mortgage Rates. Listings Surge, Home Sellers Slowly Drop Prices. by Wolf Richter • Sep 5, • The housing market heading down for a crash? Should I hold on buying a home right now, or should I wait to see if a crash happens and tisk paying more later? Perhaps no other sector was hit harder in the financial crisis and the Great Recession than the U.S. housing market. As values plummeted millions of. "Shark Tank" star Kevin O'Leary believes that the commercial real estate sector is on the brink of collapse and will bring with it ripple effects that will. Even if all short-term rental properties were listed for sale, it would not significantly impact the housing market due to the low percentage they represent of. No. Inflation has skyrocketed prices of everything, including homes, over the past 3 years. Prices are not going down. Unprecedented Growth and Consumer Debt · The Rise of Mortgage-Related Investment Products · The Markets Begin to Decline · Lehman Brothers Collapses · The. These speculative investments are, of course, driving up prices. They are also creating major problems for the economy as a whole because the rising cost of. Graph and download economic data for Median Sales Price of Houses Sold for the United States (MSPUS) from Q1 to Q2 about sales, median, housing. Even if all short-term rental properties were listed for sale, it would not significantly impact the housing market due to the low percentage they represent of. Collapsing home prices from subprime mortgage defaults and risky investments on mortgage-backed securities burst the housing bubble in We'll discuss the current state of the Miami real estate market and the factors that are driving it, including the recent economic crisis. The housing market also collapsed due to buyers lacking the equity required to sell those houses after they could not make their mortgage payments. For instance. House prices rose in January for the fourth successive month, dampening fears of an impending property market crash. The average price of a property in the. The real estate crash hasn't happened yet. But the real estate and housing market crash still hasn't happened.

1 2 3 4 5 6 7